TEBA Partners with Benefits Inc. for Nashville Policy Forum on ERISA and Dispensing Fees

- TN Employer Benefits Alliance

- Sep 3, 2025

- 2 min read

NASHVILLE, Tennessee – On August 12, TEBA held a members-only Middle Tennessee Business Policy Forum in partnership with Benefits Inc., a Tennessee-based employee benefits consulting firm. Prominent business leaders from across the state gathered at Bradley Law for a thoughtful discussion of key policy issues, including dispensing fees, forced pharmacy closures, and ERISA protections.

Benefits Inc. attorney Taylor Luther provided a detailed overview of the Employee Retirement Income Security Act of 1974 (ERISA). Luther’s technical expertise gave attendees a better understanding of the importance of ERISA preemption in preventing a patchwork of conflicting state-level regulations. TEBA extends our sincere thanks to Taylor and Benefits Inc. for their continued partnership in protecting employers’ rights.

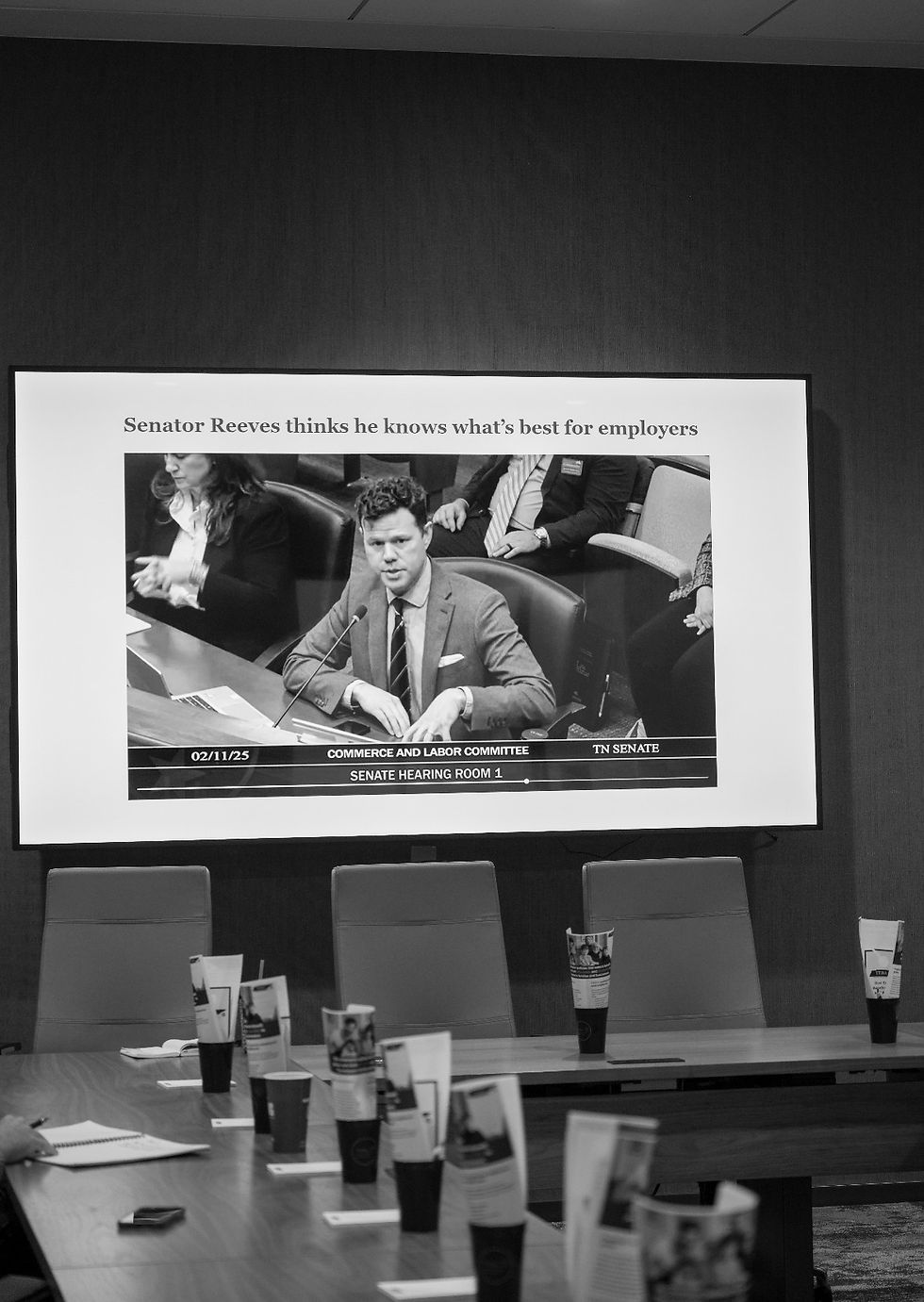

Another growing concern that resonated with our attendees was the issue of dispensing fees. These fees are paid to pharmacies to cover the cost of filling prescriptions. The legislature arbitrarily inflated the fees charged by so-called “low-volume pharmacies” by more than 500%. The legislature decided that pharmacies that fill fewer than 65,000 prescriptions per year should be allowed to charge above market rate, essentially subsidizing these pharmacies out of the pocket of other business owners and their employees.

The basic math:

A low-volume pharmacy at the 65,000 limit receives $13.16 per prescription, adding up to $855,400 annually.

A pharmacy filling just one more prescription than a low-volume pharmacy, gets only $2.00 per prescription, or $130,002 annually.

The fee difference creates a staggering $725,400 incentive for pharmacies to fill 65,000 prescriptions or less, incentivizing them to turn away patients in need of life-saving medications.

TEBA is working to ensure these artificial price inflations do not undermine Tennesseans’ access to affordable medications. We thank our friends and TEBA Board Members, David Joffe and Caleb Barron at Bradley Law for hosting our roundtable at their Nashville office and thank you to all who attended for contributing to this critical discussion.

Join TEBA to learn more about how legislative and regulatory changes affect self-insured employers and stay tuned for upcoming events ahead of session.

.png)

Comments